China's Gallium and Germanium Export Curbs Reignites Global Industries

Recycling, re-exports and tariff war are net long-term positives for the metals industry

Battery metals reporter Liubov Georges and I had a long conversation about the state of gallium and germanium supply, two metals critical for the manufacturing of semiconductors, Electric Vehicles and so much more. My commentary was featured in her article for S&P Global Intelligence (click here). Here is the fullness of my rationale behind my commentary. Read on!

China’s outsized position in the global supply chain has long been a topic of contention on a bipartisan basis in the U.S., with both President Trump (in his first term) initiating a series of tariff hikes in his first term and President Biden imposing additional levies. As I had hypothesized in my article on the Leverage Shares website, the current U.S. administration likely isn’t really looking at a form of “balancing the trade” or “easing market access” to U.S. firms. If this was true, the administration wouldn’t have rejected “zero-for-zero” tariff proposals from both the European Union and Vietnam.

Instead, it’s a gambit at depreciating the U.S. dollar without reforming currency policy by de-emphasizing petrodollar contracts, limiting the near-endless issuance of U.S. Treasury debt and ending the long-histories push for the U.S. dollar (and debt assets) to be enshrined into the world’s reserves (at least presently).

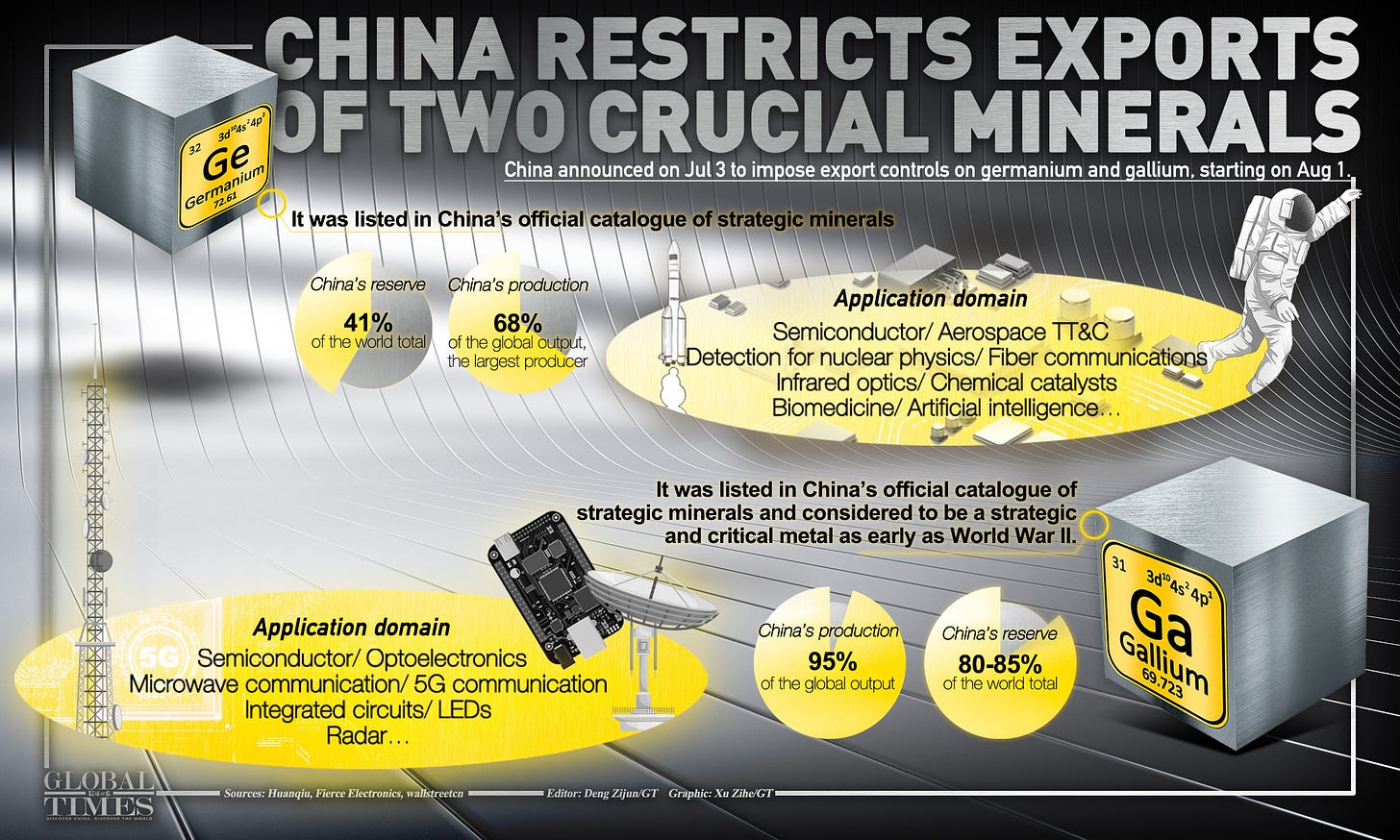

Meanwhile (and completely independently), China responded to the growing pressure by first restricting exports of germanium and gallium in June 2023 — with the state-owned Global Times helpfully explaining the utility of both via an article and this infographic:

— followed by a restriction on exports of six kinds of antimony products effective September 2024. Antimony finds wide application in military applications such as ammunition, infrared missiles, nuclear weapons and night vision goggles, as well as in batteries and photovoltaic equipment. Export restrictions over five types of low-sensitivity graphite items— used in “downstream” industries such as steel, metallurgy, and the chemical industry as well as Electric Vehicle batteries — were also implemented effective December 2023.

As President Trump’s second term was confirmed (i.e. December 2024), China further tightened export curbs of these materials to the U.S. As the tariff war began on what President Trump described as “Liberation Day” — 2nd of April — China responded with increasing levies on U.S.-made goods first to 84% starting the 10th of April, which was hiked to 125% effective the 12th of April.

Ostensibly over the question of U.S. overreliance on foreign sources (i.e. China) for critical minerals, including rare earth elements, and China’s hikes on U.S. exports, the White House released a statement on the 15th of April that the China now faces up to a 245% tariff on imports to the U.S. However, in yet another seeming walk-back from the aggressive language seemingly employed, the White House clarified that this wasn’t a hike but the maximum tariff applicable on certain products imported from China as of that date.

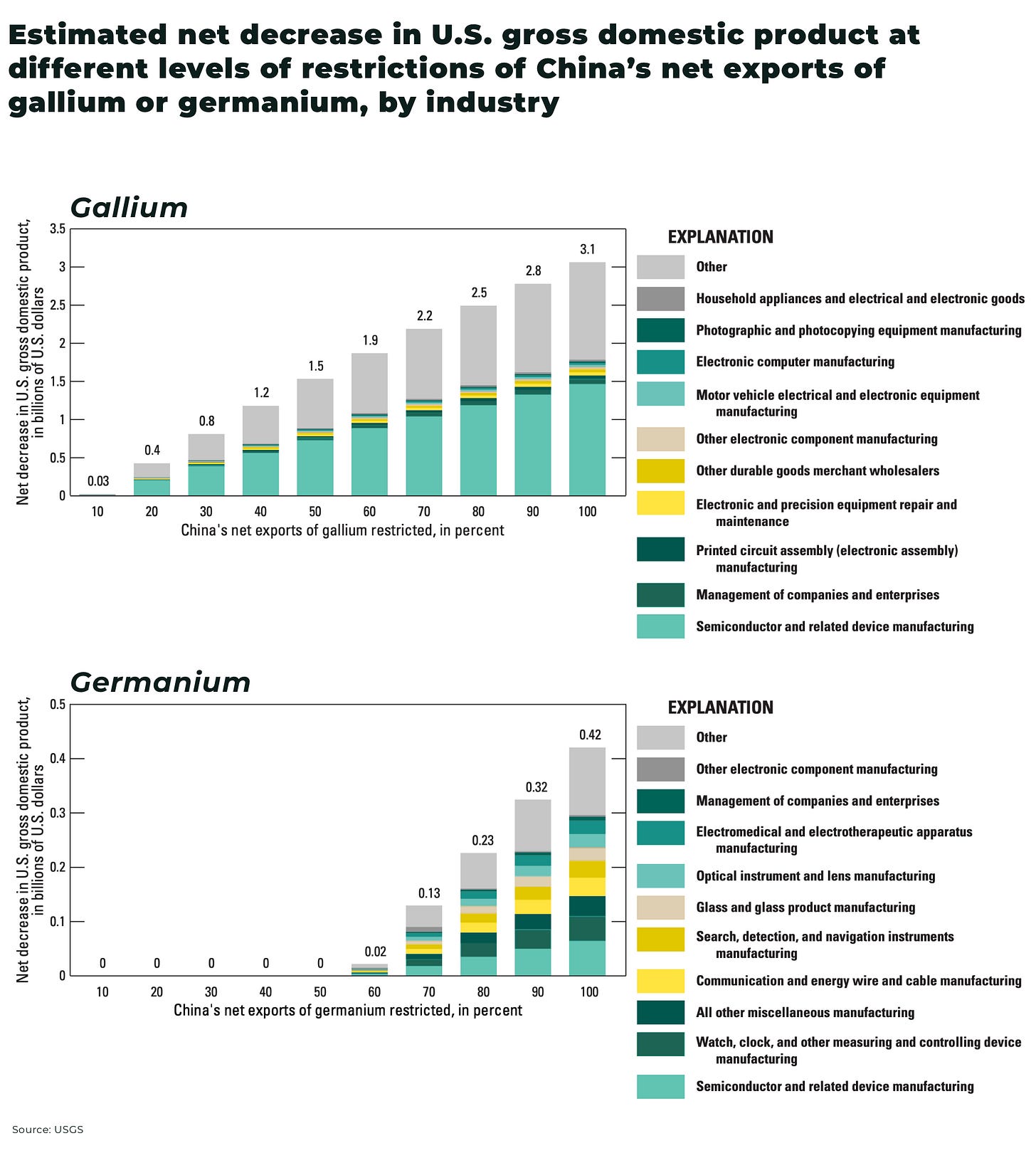

When it comes to critical materials, the U.S. Geological Survey has highlighted for some years now that China has a particularly high share in the production of gallium and germanium in “raw” or “primary” form:

Gallium and germanium also lie (almost) squarely in the middle for the U.S. in terms of vulnerability and disruption potential:

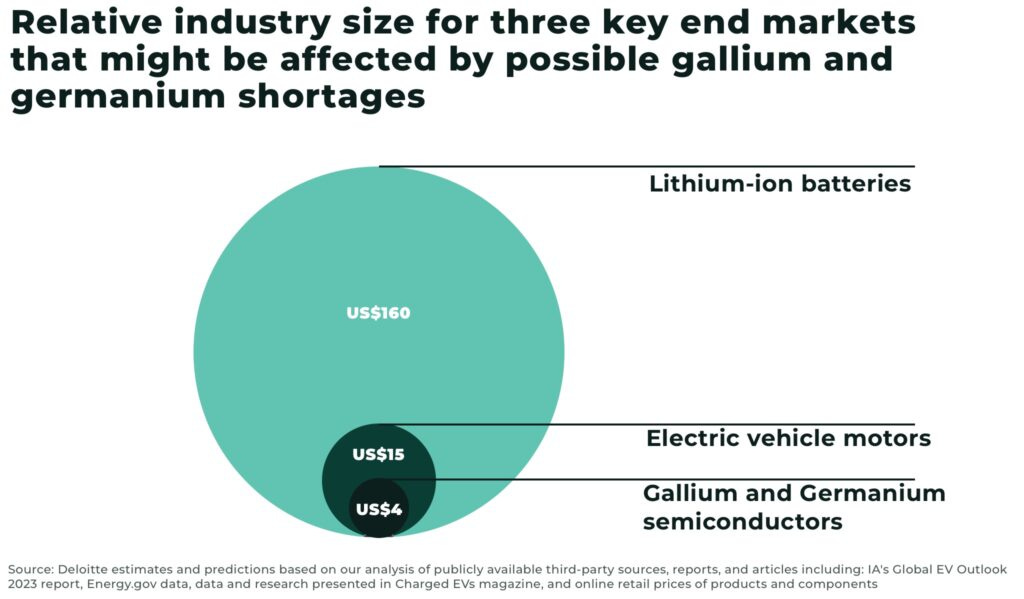

One estimate concludes that a 100% restriction on imports of gallium and germanium into the U.S. can cause about $9 billion of economic damage.

with the greatest impact being felt in the areas of EV battery and motor manufacturing as well as the semiconductor industry.

Overall, 10-year growth prospects for these materials vary widely across the board, with some estimates ranging from the low single-digit percentage range for germanium to the 20-50% range for gallium-based materials.

Of Recycling and Re-Exports

Gallium’s availability in the Earth’s crust is estimated to be around 16.9 ppm (parts per million). In contrast, copper is estimated to be around 50 ppm in the earth’s crust, zinc — which gallium is often found with — is about 75 ppm, while aluminum — which gallium is also found with — stands at around 82,000 ppm.

While China produces most of the world’s gallium output, only about 2-5% of its output is high-purity material, which is needed for producing compound semiconductors like the gallium arsenide (GaAs) and gallium nitride (GaN) types essential for high-speed electronic devices.

Approximately 95% of China’s output is sourced as a byproduct from bauxite during alumina production, with the remaining coming from the refining of lead and zinc ores. In contrast — and as a case in example — is Japan’s output for 2018: 41% of its gallium supply was sourced from scrap, 2% was from zinc refining and the remainder was sourced from China. Japan, incidentally, is a leader in the production of GaN wafers.

Most germanium is found as a by-product of zinc production and from fly ash off coal-fired power plants, with some studies indicating that recycling is possible with up to 99% efficiency. Just like with Japan, Canada’s Neo Performance Metals processes gallium out of GaN- and GaAs-based “new scrap” sent from chipmakers in Europe, North America and Asia. Canada is also the second-largest producer of Germanium outside of China mostly via Teck Resources, whose Trail Operations refinery complex receives zinc ore from the Red Dog mine in northwest Alaska and turns it into various products, including around 20 tons of refined germanium a year. Mining major Rio Tinto announced near the end of 2024 that it will explore the extraction and valorisation of gallium already present in the bauxite processed in its alumina refinery in Saguenay–Lac-Saint-Jean, Quebec. When/if fully operational, it will represent between 5 and 10% of current world gallium production.

China’s export ban, while potentially effective in spiking prices in the near term, actually erodes its position in the long run. Projects hitherto considered unviable by actors outside of both China and the U.S. due to the large supply made available to the market are now back in play: Germany’s Vital Pure Metal Solutions announced that it has been producing both gallium and germanium since the end of 2022 after an eight-year hiatus and Congo's state-owned mining company Gecamines is about to commission a refining plant that will produce copper, cobalt and 30 metric tonnes per year of germanium precipitate while Russian state-owned conglomerate Rostec stated that it can produce up to 20 metric tonnes of germanium annually and has been running at only 30% of production capacity. Numerous other “primary” sources of gallium and germanium are being activated.

Furthermore, China’s export bans didn’t really impact material flows to the U.S. Outside of the domains of the People’s Republic, China’s top germanium exports receivers were Germany, Russia, Japan, the United States, Belgium, and Taiwan. Between 2022 and 2024, a 97–100% decline in exports were registered with respect to the U.S. and Taiwan and a 75% decline in exports to Japan. However, exports to Belgium rose 224% in the same period, with some interesting patterns: the quantity of germanium exported to the U.S. fell in 2024 by roughly the same amount as the increase of its germanium exports to Belgium in the same period. China also exported roughly the same amount of material to the two countries combined in both 2023 and 2024.

Before 2022, top importers of China’s gallium were Japan, Germany, and the Netherlands. As the U.S. and the Netherlands worked together to restrict exports of chipmaking equipment to China (with Canada joining in as well), exports to the U.S. and the Netherlands went to zero from 2022 to 2024, while exports to Japan and Canada were down 36% and 41% respectively. However, top exporters of gallium to the U.S. are Canada and Germany, who both recycle gallium and also import gallium from China. In 2024, Germany accounted for 22% of the U.S. gallium imports in 2024: a massive 1,111% increase relative to 2022, which could imply either increased “secondary” production or re-exports.

Considering the fact that the U.S. industry requiring these materials weren’t impacted despite consecutive rounds of curbs tightening, it stands to reason that re-exports carried the day to keep business as usual. But the U.S. isn’t the only one profiting from re-exports. While the U.S. progressively restricted the sale of AI chips (predominantly impacting Nvidia) to China under the Biden administration, Nvidia showed an interesting trend via its report for FY 2025 (ending January) reports, which I highlighted in articles on both the Leverage Shares website as well as on SeekingAlpha: Singapore ascended to being the second-largest source of geographical revenue for the company that year. The company asserted that:

“Customers use Singapore to centralize invoicing while our products are almost always shipped elsewhere. Shipments to Singapore were less than 2% of fiscal year 2025 total revenue.“

If China alone were to be the recipient of technology sold in Singapore in FY 2025 that wasn’t utilized in Singapore’s own data center and retail demand, then China’s share in Nvidia stands at a massive 29%, second only to the U.S. at 47% and far ahead of Taiwan at 16%.

In Conclusion

On the 16th of April, the U.S. administration barred the export of Nvidia’s China-specific “slowed-down” H20 chips absent a license — which the company estimated would cause a hit of $5.5 billion. However, if re-exports were to be cracked down on, the “effective” sales trends hint that the hit could be a lot higher.

On the other hand, China’s semiconductor metal curbs have unlocked the potential of the global extraction, refining and recycling industries. While it might take a while for a monumental shift, the breaking down of the “single-axis” dependence on China that the world’s industries and governments had essentially allowed to happen is more inevitable. The upending of the status quo and the establishment of a truly globalized marketplace is a welcome and universally desirable innovation.

For a list of all articles ever published on Substack, click here.