Elon Musk's "Third Party" Isn't Unusual

What plagues the stock's valuation is a lack of fresh models in a buyer's market

In a series of interviews with journalists on the 2nd and the 7th of July, I discussed the trends hidden within Tesla’s Q2 delivery numbers, the possible impact of Elon Musk’s bid to launch a “third party” in the United States, how this affects Tesla, what truly affects the company, and the consequences of recent legislation on the automotive industry. If my comments make it into any publication, the links will be updated here. Here is the full background behind my commentary. Read on!

UPDATE: Elements of my commentary were featured within an article over at Reuters, and subsequently reposted/excerpted in New York Post, MSN, Market Screener, France’s Boursorama and ZoneBourse (i.e. “France’s Market Screener”), Canada’s CBC and iAsk, Brazil’s Click Gloria (in Portuguese), Thailand’s Kaohoon International, MSN Nigeria and Nigerian Tribune, South Africa’s BusinessLive, TradingView (also in Spanish), as well as Bangladesh’s Business Standard. Fellow SeekingAlpha contributor Cash Flow Venue also referenced my comments on Reuters in their article published on the 7th of July,

Firstly, there is a stark contrast to the language employed by President Trump before boarding Air Force One in Morristown and that on his Truth Social profile. In the former, he's dismissive of a third party succeeding while the post on the latter is a lot more incendiary towards Musk. It's pretty likely that Trump doesn't write his own posts on “Truth”; it’s possibly his ex-caddie/golf resort manager turned deputy chief of staff Dan Scavino or someone close to Scavino.

PS: It’s hard to imagine a Fordham/Wharton-educated individual born and raised in the Upper East Side using the term “kooky”; that term was jettisoned circa the ‘80s and there’s plenty of footage from his many years on reality television to show that his brogue isn’t quite so… stereotypical/archaic.

While Trump is right about a third party’s historical inability in capturing either the House, Senate or the Presidency, Elon has mentioned that his “third party’ intends to target individual Republican seats in specific elections in order to exploit the delicate balance in vote share between Republicans and Democrats. With about 2-3 Senate seats and perhaps 8-10 House seats in the bag, he can make his concerns heard. Incidentally, this was how MAGA came to dominate within the Republican Party over the course both Trump's first term and former President Biden's term.

Secondly, there are likely many Republicans who voted for the “One Big Beautiful Bill Act” (actual official name) because it’s is an omnibus but didn’t agree with the disparate provisions within: Republican Senator Rand Paul and Republican Congressman Thomas Massie both voted against it due to the massive deficit increase embedded within while Representatives Ralph Norman and John McGuire — also Republicans — were warmly effusive towards Musk in their reactions to Musk's announcement, without leveling any criticism to his plans.

This is because Musk's “third political party” is going to be to the Republican Party what the Working Families Party and the Democratic Socialists of America are to the Democratic Party: powerful voting blocs for candidate selection. Essentially, these are “voter” Super PACs instead of “campaign finance” Super PACs. American politicians know a thing or two about working with/for PACs.

As of Q2 2025, Tesla's global deliveries are trending towards a 20% decline. But a current downtrend of 21% is noted within China retail sales and Shanghai exports while it’s 18% in deliveries from the U.S. and Europe factories. Tesla’s decline in overall sales is reflective of the fact that the company has a dire problem with a lack of fresh models in a crowded buyer's market. Within the U.S., Tesla owners and dealerships faced numerous vigilante actions but early estimates indicate to us that U.S. sales are trending towards a 10% decline for 2025.

Note: The numbers were discussed in my article on the Leverage Shares website on the 4th of July as well as on SeekingAlpha and the Tiger Brokers Community platform.

While Q2 and Q3 are typically high-volume months in the auto industry, the U.S. EV market had already been trending towards an 8-10% decline in sales for 2025 before the passing of Trump’s much-vaunted “One Big Beautiful Bill Act”. While it's true that Tesla’s share in the U.S. EV market has been in decline and overall deliveries haven’t grown in tandem with U.S. market trends for almost five years now, a match in decline within the U.S. indicates that vigilante actions on U.S. owners and dealerships possibly boosted buys into the Tesla catalogue to effectively arrest the decline to some extent.

PS: This was offered as a possibility for sales going forward in the course of my conversations with journalists after Tesla’s Q1 earnings call. Nice to know that the data seems to be suggesting that this is a factor in sales dynamics.

While the cancellation of the EV benefits under the “One Big Beautiful Bill Act” (again, official name) is a blow to American EV buyers, it impacts the cheaper alternatives to Tesla’s products more: priced upwards of $40,000, Tesla’s current lineup could hardly be considered “budget” choices. The company seems well aware of this. During the company’s Q2 2024 earnings call, Musk commented on the impact of a potential rollback on EV subsidies:

I guess there would be like some impact. But I think it would be devastating for our competitors and would hurt Tesla slightly. But long term, probably actually helps Tesla, would be my guess.

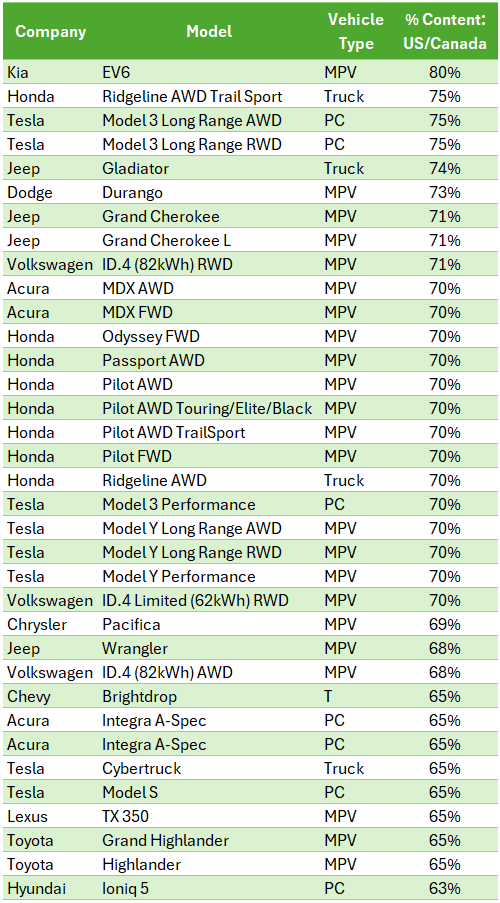

Also, the Trump administration’s tariff wars are still underway and Tesla comes out as least affected among all its competitors: in the report published by the U.S. National Highway Traffic Safety Administration as of the 4th of July 2025, Tesla’s current lineup averages to around 65-70% of its components being sourced/manufactured in the U.S. and Canada:

The only companies that come close to having as much in U.S./Canadian-sourced components in the EV space are Volkswagen’s ID.4 and Hyundai’s Ioniq 5 and EV6 (under the “Kia” badge).

Meanwhile, among its U.S. competitors, General Motors’ Blazer EV (manufactured under the “Chevrolet” badge) and its Equinox EV are both produced at General Motors’ Ramos Arizpe plant in Coahuila, Mexico. Ford’s Mustang Mach-E is assembled at Ford's Cuautitlán Stamping and Assembly Plant in Cuautitlán, Mexico.

Under the tariff war — absent a permanent halt in heightened tariffs for Mexico-made products — it’s advantage Tesla, Volkswagen and Hyundai.

The “One Big Beautiful Bill Act” also has a provision that lets car buyers write off up to $10,000 a year in interest paid on qualifying auto loans taken out between 2025 and 2028 for the purchase of U.S.-assembled cars. There is no purchase price limitation but there are income limitations that kick in at $100K single/$200K married. Tesla is a decidedly American carmaker with facilities and only a small portion of buyers can be assumed to be buying Teslas in cash.

Furthermore, there are new requirements for sourcing of battery minerals and components. The battery cells in every Tesla vehicle except for the Model S/X are U.S.-produced. Tesla has had a long-standing partnership with Panasonic for the manufacturing of its battery packs in its Nevada and Texas factories. Tesla’s own Cathode Active Material plant and a lithium refining plant are expected to come online this year. While General Motors While both Ford and General Motors have partnerships with South Korea’s SK On and LG Energy Solutions (respectively) for the setting up of battery plants, most other carmakers lean on foreign manufacturers with varying levels of dependency on supply chains connected outside the U.S. These factors too will be an additional cost burden on other EV carmakers in the U.S. market.

Thus, Tesla buyers stand to benefit in savings even if EV tax credits are erased. Simultaneously, however, the overall outlook for U.S. EV demand is expected to decline in the years to come on account of the erasure of green energy benefits potentially pushing up production costs/sales prices.

The shrinking of the U.S. market lies particularly heavy on Tesla's stock valuation, which is currently also under pressure from the lack of freshness in its catalogue to appeal to its present buyer segments — which in turn affects its market share both in its home turf as well as abroad.

As of 11:45AM GMT (London) on the 7th of July 2025, traded volumes in the Leverage Shares -3X (Short) ETP (TS3S) — which provides magnified exposure to the downside of Tesla stock — witnessed a 282% increase in traded volumes relative to Friday while the Leverage Shares 3X ETP (TSL3) — which does the same but for the upside — witnessed a 213% jump.

Before November 2024, TSL3 had generally always held a premium in traded volume: TSL3:TS3S ratios (i.e. “leveraged long” to “inverse long”) stood at an average of 2.7X in July 2024, 5.3X in August 2024 and at an average of 2.95X in September, and 2.1X in October 2024. This ratio flipped to 3X in favour of TS3S in November 2024, 12.56X in December 2024, and 16.5X in January 2025. As of 11:45AM (GMT), this ratio stood at 8.66X. For comparison with the nearest full month, the ratio in favour of TS3S stood at an average of 13.6X in June 2025.

Note: “Volume” here denotes “number of units traded” and not “average dollar volume”. As of 11:45 AM (GMT), TS3S was priced at $0.142 and TSL3 was $9.0875. In dollar volumes, TSL3 has always been several magnitudes higher than TS3S.

Robotaxi, Consequences/Retaliation, and Other Matters

While that the Trump administration is frequently deemed as being vengeful towards those who crosses them or their mercurial leader — the President — some concerns might lean into the prospect of retaliations designed to impact Tesla and its business. However, given how central Tesla is to American automobile manufacturing (and the high watermarks it has established in vertically integrating its supply chain domestically), it’s unlikely there will be any state support for retaliation. Both Texas and Nevada — sites to key Tesla factories — are Republican strongholds who welcome the jobs created therein by Tesla’s presence. Texas is home to ongoing trials of Tesla’s robotaxis within Austin while Nevada has competitor Zoox running trials in Nevada. Current industry leader Waymo is working its way into the city of Miami in Florida — another Republican-ruled state — later this year.

Tesla’s Robotaxi is a rich new vein for the company’s massive production network to tap into while demands for EVs decline, given the perhaps inevitable continued loss of market share among individual buyers looking for something fresh. Some estimates for Waymo assign a price tag of nearly $250,000 for a car to be made fully autonomous. The initial Robotaxi launch in Austin (Texas) utilizes the existing Model Y with little by way of additional hardware. If this is the template that will be followed for full-scale rollout, there's potentially a solid one-third to one-fourth price advantage over the existing competition. For potential Robotaxi fleet operators, this is a massive incentive.

Tesla will likely be keen to test its technology versus its competition and can be expected to enter these regions for comparative results. By now becoming essentially an outright “political influencer” by way of moving deficit- and inflation-weary voters via his “third party” to curated candidates, Musk might have (contrarily) made state and local governments more amenable towards his company’s ongoing work. Thus, if the market is concerned over Tesla’s future expansion of research and business interests within the United States, this is likely unfounded.

On the other hand, Tesla as a stock — and the valuation of thereof — seems centered around Musk far more than the deep bench of innovators within the company. With increasing “political” work (again), there will inevitably a number of investors who are very wary of attention being diverted from the task at hand — be it in Tesla, Starlink, Grok, or even The Boring Company. Those that invest in Musk but not Tesla will find this new endeavour a little too much and might clamour for board intervention — which might not happen.

For investors not prone to these concerns — namely retaliation or Musk’s centrality to valuation — who are most likely to be the silent majority of Tesla’s investors, the shrinking market share is a prime matter of concern. While Robotaxis might potentially create solid captive demand for Tesla, the successful completion of Robotaxi trials could possibly take years — at least going by how long Waymo has been running trials — which means that much will hinge on whether Tesla can create fresh new models on both premium and budget segments to attract its traditional segments who have been turning away from its products and new budget-conscious buyers who haven’t bought into Tesla’s existing catalogue on account of the $40,000+ tag.

Be it Musk or Tesla, there is plenty to pooh-pooh for some — perhaps even justifiably sometimes. But, nonetheless, Tesla's earnings call on the 23rd of July would likely be a very interesting one. Updates on Robotaxi trials and/or fresh new models would likely be bullish signals. The automotive industry has never been a sprint; it's a marathon. And Tesla — like its boss — remains a very interesting participant.

For a list of all articles ever published on Substack, click here.