Global Markets Outlook: YE 2025 and Beyond

U.S. trending towards running flat while markets in Europe and India boom.

A few weeks ago, I had a couple rounds of conversations with journalists about the outlook for various equity markets for both this year and the next, macroeconomic factors affecting said outlook and so forth. When/if included in an article, I shall post the links here. For now, here is the fullness of the rationale behind my commentary. Read on!

Over the course of 2025, the U.S. administration’s tariff war has had a momentous impact on the global order and strengthening the outlook for regional differentiation. Markets across the world have significantly altered tailwinds as a result.

Market Outlook: Select Regions

The 90-day truce in the tariff war should give U.S. consumer-facing firms time to stock up inventories. However, it’s unlikely that the U.S. and China will come to terms after this period. With consumption costing more on an aggregate basis along with resilient inflationary pressures, risk-offs are inevitable on market-leading tech firms. Risk-offs are bound to favour high-quality mid- and small-cap U.S. stocks but overall market directions are expected to be muted relative to the recent past.

The Dow Jones is expected to shift slightly higher in Year-on-Year (YoY) terms, with the broad-market S&P 500 inching slightly higher in comparison.

Meanwhile, Canada’s S&P TSX is expected to carry somewhat higher on the back of tariff war-induced economic linkages with Europe and the rest of the world. In a similar vein, European markets’ outsized market favour is expected to cool off and factor in recessionary blowbacks on consumption to shave off some of the gains seen in the Year Till Date (YTD) to close 2025 with a weak double-digit percentage YoY gain. “Size” is a factor that will draw investor conviction so the STOXX Europe 600 is expected to close comparatively lower.

Japanese equities are expected to continue inching lower in conviction. Key pressures on Japanese goods are increasing availability of substitutes from regional leaders, lowering consumption in the domestic front and higher tariffs on Japanese goods — which traditionally find a significant market in the U.S. One giant regional leader is India, which is expected to continue on a quarter century-long trend of YoY gains into this year. The United Kingdom’s FTSE 100 is expected to benefit both from the comparatively-lower tariff regime imposed as well as the potential for a Free Trade Agreement with India.

In 2026, the current year’s growth trends are expected to discount some of the outsized growth in some markets or — in the case of India — expected to go from strength to strength on the back of strong retail investor conviction as well as international growth investor buy-in. However, convictions — in many cases — are distinct from fundamentals.

Earnings and the Potential for Market Corrections

Indian companies’ earnings are expected to remain strong off increased government spending on infrastructure, defense, et al. Consolidation of operations and hive-offs will aggregate to slightly higher reported earnings among market-leading U.S. and Japanese companies.

Recessionary/inflationary pressures across Europe while lower consumption (both global and domestic) coupled with operational reorientation of leading companies in China are expected to result in lower aggregate earnings in these markets.

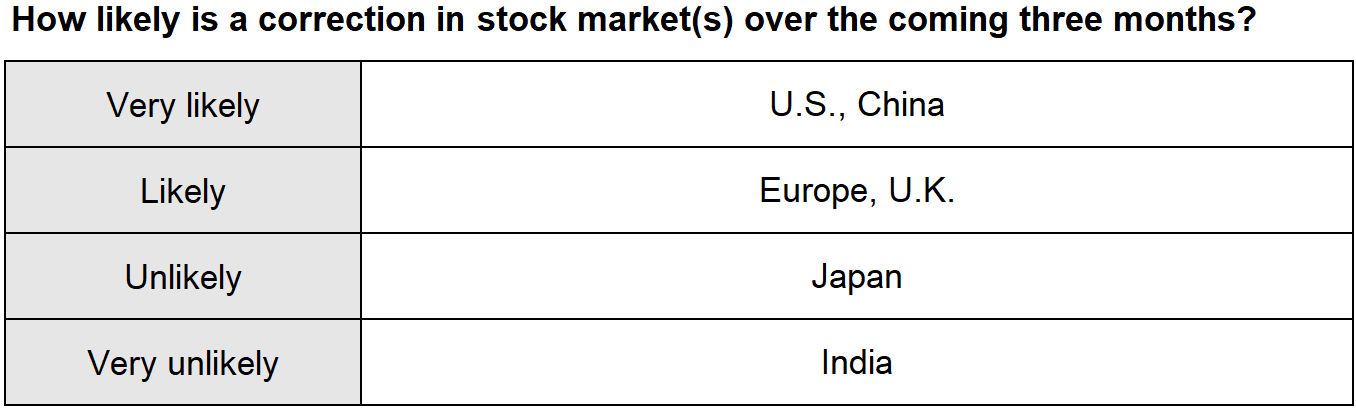

Overvaluation in U.S. and faltering conviction in the “broad China growth” narrative are expected to create a heightened likelihood of correction in both these markets

Meanwhile, the strong conviction seen in the first half (H1) 2025 will likely see a relatively modest correction over in Europe. Japanese investors — who tend to lock in on a long-term basis — and domestic institutions will make a substantial correction in Japanese bourses somewhat unlikely.

China, India, the semiconductor industry and various other topics have been featured frequently in past articles. For a list of all articles ever published on Substack, click here.