Is Apple Going from "Growth" to "Value"?

The Epic Games lawsuit's aftermath doesn't exactly help Apple's growth story

In a conversation with Benzinga journalist Surbhi Jain, I discussed signs of Apple evolving from a “growth” stock to a “value” stock. Portions of my commentary can be found in Surbhi’s article here on Benzinga, which was also syndicated on Moomoo’s platform (click here) as well as on sister company Futubull’s platform (click here). Here is the full reasoning behind my featured commentary. Read on!

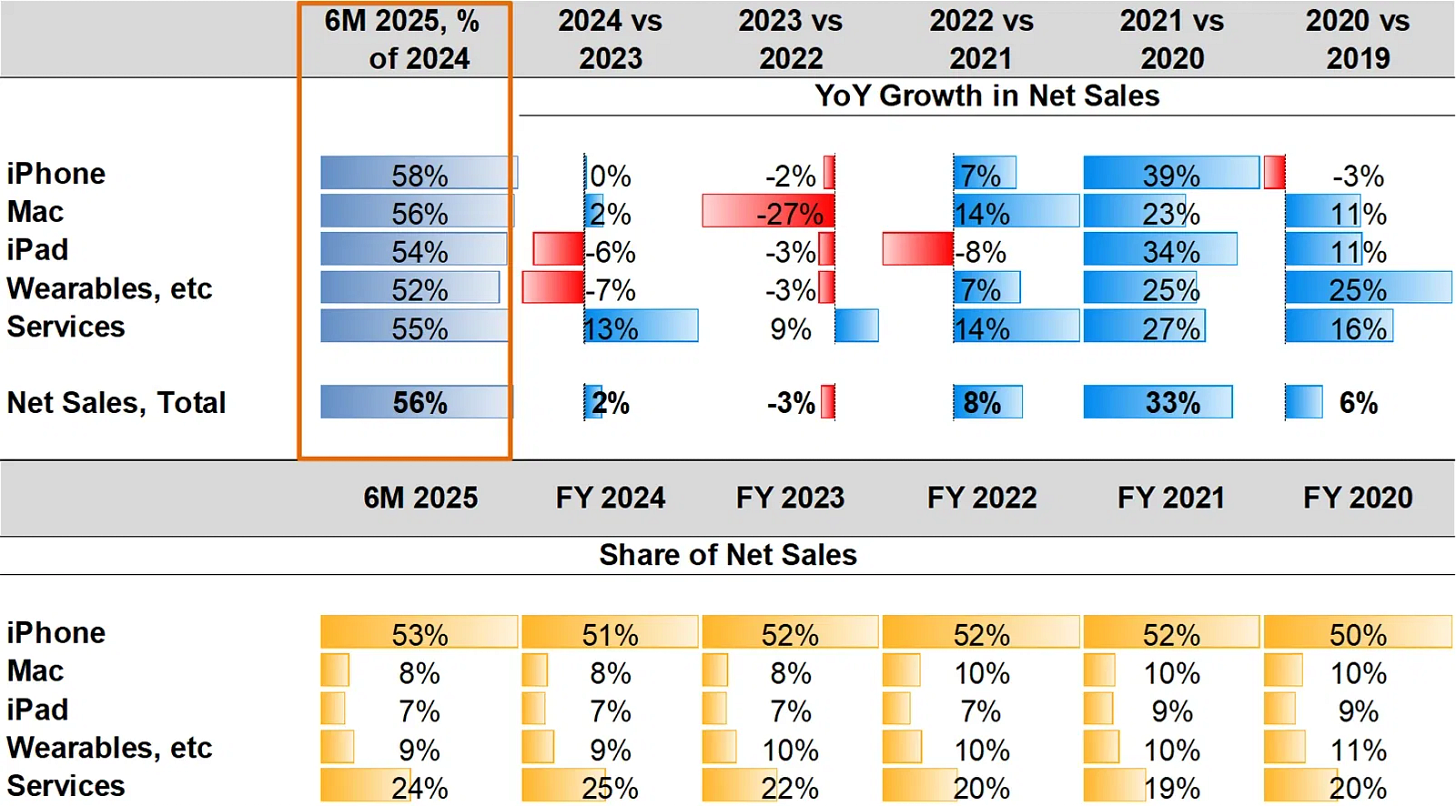

At first blush, Apple’s financials seem largely positive so far. As of Q2 2025, practically every region had registered an uptick in net sales trends.

While sales in China had been in decline in the past two FYs, China showed slight signs of improvement in the first half of FY 2025. Other regions more than made up for the downturn in the China market, resulting in a slight uptrend. By far, iPhones have been the leading component of net sales trends both historically and currently.

Note #1: A more detailed analysis of Apple’s Q2 earnings was published in May over in the Leverage Shares website as well as in SeekingAlpha.

Services, by far, was the most promising alternative to the dominance of the iPhone in the company’s product and services mix. With the aftermath of the company’s legal battle with Epic Games, however, this segment is poised to weaken.

Democracy for Apple’s “Captive Audience”

In 2021, Apple had largely prevailed against Epic Games — better known as the developer behind for the virally poplar game “Fortnite” — in a legal battle brought upon the former by the latter. However, where Apple was required to modify its business was in relation to payment options for “in-game transactions”. Almost five years later, it was found by the very same court (and judge) to have been in contempt of the ruling issued by the court in this matter, thus invoking its ire and a demand to immediately comply.

In FY 2024, App Store commissions is estimated to have constituted roughly 10% of Services revenue. The exclusion of commissions from in-app purchases is a substantial blow to margins. Commissions from in-app purchases cost the company virtually nothing while boosting Apple Pay’s transaction activity and user base. This was even more apparent in games: globally, in-game purchase revenues are estimated to run at 8-10 times the revenue earned from game subscriptions.

Note #2: A larger discussion of the economics of the games market and how this benefits Apple was published earlier in June in the Leverage Shares website as well as in SeekingAlpha.

With this being excluded, the company’s App Store revenue can be expected to shrink by 80% over the next two fiscal years, as gamers and app users veer towards “webshops” that don’t require developers to pay the company its 30% commission or require users to have an Apple Pay account. While this would translate to a 2-4% reduction in total net earnings for the company over the next two fiscal years, it’s a momentous blow to the Services division, which now needs to drive margins from providing cloud infrastructure and content.

While the company does produce premium content, the creative media industry is in a state of glut. There’s plenty of content available on plenty of platforms. Apple doesn’t quite command as much of a commanding position in drawing eyeballs and dollars — despite the numerous accolades and awards it content attracts — to justify repeated massive outlays required to produce content, now that commissions revenue can be expected to slip. In a similar vein, corporate clients have a plethora of competitively priced cloud platforms to choose from, including Microsoft and Google. In effect, there's a repeat of the story seen in the product lineup: there’s no clear edge to justify premium stock prices.

Conviction Shifts and Possible Bullish Triggers

In its latest WWDC, Apple hinted at opening up its foundational AI models to developers in a bid to democratize its ecosystem for developers, but this is several cycles behind and fundamentally different from what is being offered at the likes of Meta Platforms and Google.

While its measured response in the face of AI hype is reassuring – given that several estimates contend that tech giants might have overcommitted to datacentres and R&D with little measurable impact and long timelines for return on investment (ROI) – its late-stage announcement with little to show by way of “levelling up” with features already available among competitors puts it at a disadvantage and undermines its valuation multiple.

Any market consideration over Apple Inc still being in “growth” phase might be largely misplaced. While it’s true that the company offers an end-to-end ecosystem connecting products and services, it is hardly unique — the Android universe does more and has a vast variety of manufacturers offering products at different price points and specifications for customers to choose from. By way of features and product innovation, there is precious little in Apple’s product and services lineup to convert vast droves of customers.

Apple’s net sales are trending to close the year with a 12% increase over the previous year, which essentially means it’s flat after accounting for inflation bumping up product prices. Thus, Apple is better understood as a “value” stock instead of a “growth” stock: the price premium in its products yields its image considerable brand equity without delivering explicitly superior performance, which will attract a fairly stable consumer base.

Investors looking for stable returns would find that the company is increasingly likely to become a bellwether for the global economy, much like energy firms and financials are — a rare but not altogether impossible feat for a tech stock. Unlike energy firms and financials, it isn’t a very good stock for dividend income at first glance: a $0.26 quarterly dividend pales in comparison to that offered by Royal Dutch Shell or BP but is significantly better than the paltry $0.01 offered by Nvidia. For Apple, this might be an interesting niche to occupy for dividend-driven investors to diversify into.

However, price growth-seeking investors should be mindful that Apple might be settling into a “new normal” as it seems to be shedding its high valuation premium relative to peers. The stock’s performance versus the rest of Magnificent 7 is indicative of a structural shift in progress, as market conviction relegates the stock from “growth” to “value”. However, current conditions do create a potential opportunity for contrarian investors: as the U.S. fiscal deficit widens in the wake of what President Trump refers to as the “Big Beautiful Bill”, there will be a flight of capital from the bond market into equities. Over the past five years, most capital flight events from bonds to equities had favoured large tech companies more so than any other stock. Regardless of fundamentals, this will likely boost the valuation of Apple’s stock on a tactical basis.

In terms of looking for bullish triggers, the tariff regime between the U.S. and India as well as China is one factor to look at. India is increasingly home to Apple’s assembly operations while China remains a key source for components and material. While Aplpe would be willing to absorb some costs from tariffs, it wouldn’t do so for sustained periods. Easing tariffs — or even an exception made for companies with a distributed supply chain such as Apple — would aid in boosting the outlook for the company’s margins.

Another interesting event to look for is if Apple does an “Android” play and opens up iOS to other manufacturers. While this might help build new revenue streams, it might come at the cost of steady product sales. The prospect of the latter likely acts as a barrier to such a decision being taken presently. At any rate, there isn’t much currently to justify its standing as a “growth” instrument. Thus, seekers of explosive growth might be better off looking elsewhere.

At around the same time, I also had an extensive discussion about platinum with MarketWatch, which can be found here. For a list of all articles ever published on Substack, click here.