Late in September, an Italian publication asked for my take on the U.S.-Taiwan-China imbroglio, which I delivered just before the general elections. Giorgia Meloni - a right-wing politician with a certain repute among mainstream media - went on to stun pundits and win, leading to a deluge of coverage that buried the submission in terms of priority. C’est la vie. Here it is, with updated data and additional nuance. Read on!

During a media interview on the 18th of September, President Joe Biden stated that U.S. forces would defend Taiwan in the event of a Chinese invasion, unlike in Ukraine. Chinese officials deplored the statement leading to a spokesperson representing the White House to subsequently state, “The president has said this before, including in Tokyo earlier this year. He also made clear then that our Taiwan policy hasn’t changed. That remains true.”

The “policy” regarding Taiwan has been one of “strategic ambiguity” designed to keep the adversary guessing on consequences. In 1972, U.S. policy acknowledged that “all Chinese on either side of the Taiwan Strait maintain there is but one China and that Taiwan is a part of China” and “does not challenge that position” in 1972. In 1979, President Jimmy Carter formalized ties with China while also passing the “Taiwan Relations Act”, which guarantees support and asserts that the U.S. will help Taiwan defend itself, leading to a steady trend of weapons sales to Taiwan. Critically, the Chinese government states that the “One China” principle explicitly makes the Chinese Communist Party (CCP) the sole legitimate government of “One China” which includes the mainland and Taiwan.

As a result, Taiwan continues to not be represented by any organization in the UN or most of the world. But under the idea of “strategic ambiguity”, it resorts to numerous naming conventions and strategies to find representation nonetheless.

The core conflict between China and Taiwan lies in the latter’s origins. In the early part of the 20th century, the dying Qing Dynasty – which ruled most of modern China and Taiwan for nearly 3 centuries – crumbled under growing calls for direct rule and replaced by a government led by Dr. Sun Yat-sen in 1912 who ushered in the “Republic of China”. After several trials and tribulations – including war between former Qing Dynasty officials/vassals-turned-warlords and revolutionaries – Dr. Sun’s “Kuomintang” party (KMT) initiated a policy of active cooperation with the CCP under Soviet counsel (Vladimir Lenin had frequently expressed admiration for Dr. Sun) in 1923. After his death from illness in 1925, this alliance frayed and devolved into a civil war between the KMT and CCP, which saw brief respites and even military cooperation after Japan began an invasion of China in 1932. From this period till 1945, the KMT predominantly fought military campaigns against the invaders while the CCP predominantly conducted guerrilla-style operations.

After Japan’s defeat in 1945, the KMT received U.S. support while the CCP had Soviet backing. Furthermore, the CCP had vastly increased its support in China’s impoverished rural regions while the KMT was a decidedly more “metropolitan” force, enriched by the takeover of Japanese commercial assets left behind. By 1949, the CCP had established its dominance in most regions in the mainland while the KMT departed with nearly two million soldiers (and untold numbers of supporters) to Taiwan where KMT chief Chiang Kai-shek established the “Republic of China” once again. Meanwhile, in Beijing, CCP chief Mao Zedong established the “People’s Republic of China”. In order to cement legitimacy of rule and in recognition of the roots of modern China’s destiny, Dr. Sun was declared the “Father of the Nation” in the Republic of China and the “Forerunner of the Revolution” in the People's Republic of China.

While both Taiwan and China were effectively set up as one-party states, Taiwan’s government implemented several reforms in the nineties that have led to a full parliamentary democracy. In this period, bonhomie with the mainland increased, leading to many Taiwan-based companies — such as Apple supplier Foxconn — operating factories in China. Concerns over this growing closeness led to the formation of the Sunflower Student Movement, which stormed and occupied Taiwan’s parliament in 2014 after the ruling KMT attempted to ratify the Cross-Strait Service Trade Agreement (CSSTA) which the movement felt would endanger Taiwanese independence and bring Taiwan under the mercies of Beijing. The opposition Democratic People’s Party (DPP) supported this movement as well, along with many in academia and society – leading to this agreement never being ratified. The DPP went on to win parliamentary elections by a landslide in 2016, with Tsai Ing-wen becoming Taiwan’s first female president. President Tsai went on to win again in 2020 with an increased vote share.

The Cudgel of Trade

Despite the increased shift towards a more resolute and independent Taiwan, trade relations are deeply entrenched in mutual dependence between the two Chinas. China and Hong Kong received 42% of Taiwan’s exports last year. More than half were electronic parts, followed by optical equipment. About 22% of Taiwan’s imports last year came from China and Hong Kong.

Outside of China, however, the U.S. is the largest recipient of Taiwanese exports. As per the U.S. Congressional Research Service, Taiwanese businesses received $200.1 billion in U.S. export orders in 2021. The biggest export orders belonged to the categories of communication products, followed by electronics, metals, machineries, chemicals, plastics, and textiles. Exports to the U.S. nearly doubled, growing by 97% between 2016 and 2021 while exports to mainland China grew by 71%.

In the same period, Taiwan’s imports from mainland China have surged by about 87% versus 44% growth in imports from the U.S.

On the other hand, U.S. imports from China – first conceived as an incentive to further cement the Sino-Soviet split and potentially transform China into a democracy (the latter never really happened) – has had a fair bit of cyclicality – with post-lockdown 2021 showing a massive upswing with a value more than twice that of Taiwan’s received exports (which is not the same as exports made as of that year).

Overall, the U.S. Census Bureau has a slightly more conservative estimate that shows Taiwan’s imports, exports and balance of trade with the U.S. is smaller by a 70-90% margin relative to those figures with China.

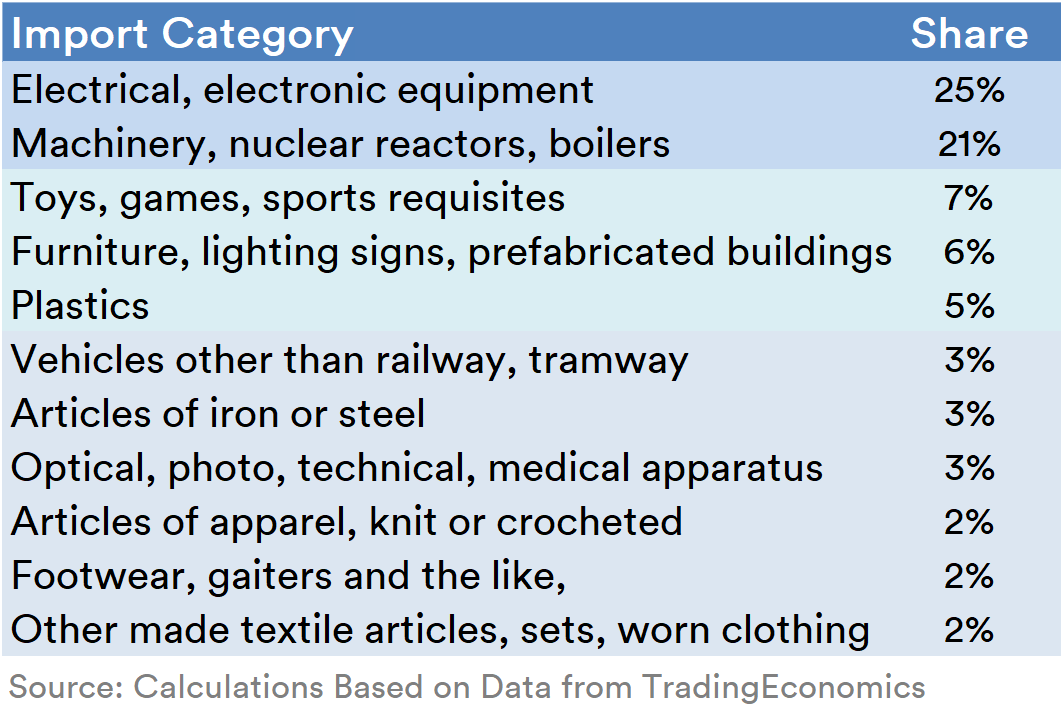

Overall U.S. imports from China are predominantly in electronics, machinery (which include machine parts, et al) and so forth. As per the U.S. Department of Commerce, “Mechanical Appliances, Sound Recorders and TV sets” form 29.3% of imports by value from China – which has a whole holds a 17.9% share of all U.S. imports of $2.8 trillion in 2021.

In contrast, over 60.8% of the $77 billion in imports from Taiwan were “Machinery & Mechanical Appliances” as per the U.S. Department of Commerce. Overall, only 2.7% of all U.S. imports were from Taiwan.

The Problem of Indirect Dependence

In light of the tensions between the U.S. and China over the Taiwan issue, there remains a critical area of dependence that was brought to light by events like the pandemic: the pharmaceutical sector. Most sources claim that only around 1-1.2% of all imports from China into the U.S. are pharmaceutical products. However, in reality, this is a somewhat incomplete figure.

The cornerstone of pharmaceutical production lies in Advanced Pharmaceutical Ingredients (APIs) — chemicals that are responsible for the therapeutic effect of drugs. After China ramped up API manufacturing in the 1990s across its 7,000 drug parks with infrastructure such as effluent treatment plants, subsidized power and water, production costs in China fell sharply leading to its rise as the primary source of APIs to the world.

As per the US-China Business Council, as of 2019, only 6% of all APIs used to manufacture medicine consumed in the U.S. were from China.

That same year, the U.S. Food and Drug Administration (FDA) acknowledged that it “does not know whether Chinese facilities are actually producing APIs, how much they are producing, or where the APIs are distributed.” This is an interesting turn of phrase for it suggests that the converse is also true: it is difficult to determine if an API produced in, say, the EU doesn’t have the Chinese bulk chemical manufacturing industry providing most of the material. Thus, this is a case of an “indirect import” dependence.

Case in point: as of 1991, India imported only 1% of its APIs from China. After Chinese initiatives drove down production costs, the Trade Promotion Council – an Indian government-supported organization – estimates API dependence on China as of 2021 at about 85%.

The Indian government has taken exception to this growing dependency as an erosion of its sovereignty and put in place substantial incentives to increase self-reliance in this sector. The first phase of these measures is estimated to result in reduction in imports from China by about 25-35% by 2029. Furthermore, it is estimated that the republic’s $42 billion pharmaceutical sector will be able to boost domestic manufacturing via these measures by $520 billion by 2025, thus implying a long-term momentum in the goal towards self-reliance.

It costs a pretty penny to undertake such radical restructuring. In India, national objectives trump economics and Indian companies have typically risen to the challenge of holding on to their turf by all means possible. This is true for the populace as well: a few years ago, the public realized that a majority of the fireworks used in the country’s Diwali celebrations originated from China. A groundswell of “Boycott China” sentiment resulted in an upswing in sales of more expensive India-made fireworks to the extent that the Chinese-origin fireworks business was reduced to a small minority in the total market. With the growth in business came economies of scale to Indian manufacturers; today, they rule supreme in their field in India.

Another form of “indirect import dependence” has been in the news recently: Lockheed Martin’s production of the F-35 Lightning II - a 5th-generation jet that received mention in the last 2-part article about aircraft industries in India and South Korea (click here for Part 1 and here for Part 2) - had to be halted after an engine component was found to made from an alloy sourced from China, which is a technical violation of U.S. defense acquisition policies. This was resumed after a waiver was procured for the alloy. There are some parallels with a similar incident (or allegation) in India from over 10 years ago: the Indian government had procured the “Admiral Gorshkov”, an aging Soviet-era helicopter carrier, from Russia with a refit agreement that would transform it into a modest aircraft carrier so that gaps in its fleet due to the upcoming retirement of its existing British-made aircraft carriers were plugged at least until indigenously-produced carriers were introduced. The refit was plagued with problems that required Russia’s then-President Dmitri Medvedev to personally intervene and chastise the Russian shipyard’s general director on television. After the aircraft carrier’s boilers broke down in its maiden voyage to its new home, the Russian shipyard attributed this to low-grade firebricks made in China. This provoked a furious response from Indian officials since the likes of China are excluded outright in the list of acceptable supplier nations. A stung Chinese government also categorically denied exporting the firebricks to Russia.

Crisis in a Time of Recession

In macroeconomic terms, Taiwan’s share in imports to the U.S. is very small relative to China’s and U.S. businesses’ dependence on China is very heavy. With higher costs due to runaway inflation, the current U.S. administration would be very hard-pressed to not increase costs on the consumer/voter. This makes the notion of an enforced boycott and domestic replacement (which will be more expensive) far more unlikely. Similarly, pressing on the likes of India to become an international replacement for China has two problems: firstly, unlike China in the nineties (which focused on building its global exports imprint), India is focused on meeting domestic consumption in a population that is rapidly rising in personal wealth. Thus, exports would ideally come after self-reliance is met. Second, even if capital were laid out by a series of international parties to facilitate the setting up of economic infrastructure for the purpose of replacement, it will be a decade or so before the switch can be completed. Both objectives put together imply an optimal scenario of 15 years or more.

In the scenario of a Chinese “special operation” in Taiwan, the U.S. might also find itself hard-pressed to shoulder the sheer cost of armed response. Mandatory entitlements and interest comprised 70% of the U.S. budget in 2022. Medicaid, the Children’s Health Insurance Program (CHIP), and Affordable Care Act (ACA) marketplace health insurance subsidies together accounted for 26% (or close to $1.5 trillion) of the U.S. budget in 2022. Half of this amount, $740 billion (14%), went to Medicare, which provides health coverage to around 80 million people, either citizens aged 65 and older or those with disabilities. In 2023, $5.6 trillion of marketable debt and $2.6 trillion of government debt held by Social Security (23%) matures. In 2024, more than $3 trillion of debt matures. Because of rising interest rates, the U.S. government will likely have to spend hundreds of billions more next year just to service the debt, leading to expectations that the debt ceiling will be breached in June. Defence discretionary spending is 14% of the budget while non-defence is 16%. Thus, the U.S. government has to weight the definite economic costs of an armed response while the political costs are complex and nearly incalculable.

Thus, despite Chinese exports falling due to reduced global consumption patterns, the U.S. will be hard-pressed on framing an appropriate response. In terms of blunt economic importance for the U.S., Taiwan is lower than China. If China were to take direct military action on Taiwan, there is no guarantee that the U.S. government wouldn’t go beyond just platitudes. Platitudes aren’t known to stop bullets and shells.

Overall a good an interesting piece. However, it should be noted that when the KMT withdrew to Taiwan that it treated the local Taiwanese as second class citizens. Recent surveys indicate that at least

eighty percent of the Island's population prefers independence rather than political reunification with China. For the KMR to favor reunification with the mainland goes directly against the will of the majority of the population. The vote favoring the KMT in local elections is more a statement about unhappiness about local administration than an expression of any desire for reunification with China. On the ground reality is very different from any possible reading of the tea leaves from a distance.