A Key Factor that Affected Supermicro's Earnings in Q2/FY 2024

Full context for commentary made during today's Hankyung TV broadcast

Earlier today, my colleague Bora Kim appeared on Hankyung TV, a 24-hour business news channel in the Republic of Korea, to discuss my recently-published analysis of SMCI’s Fiscal Year trends, one key factor that weighed down its earnings, and other matters of concern for the stock. See Bora’s segment here on YouTube. For the English-language version of the analysis, read on!

San Jose-headquartered Super Micro Computer, Inc. (ticker: SMCI) — better known as “Supermicro” — had been in operation for a long time and was relatively unremarkable in that it was just one of several companies building servers and storage systems for computing hardware (among other server-related areas). The company doesn't manufacture chips, per se, but rather assembles the server around a chipmaker's products in the most efficient manner. The founder, Charles Liang, holds numerous patents in server technology and the company went on to become one of the largest producers of high-performance and high-efficiency servers. His wife was the treasurer until 2019 (she remains on the board of directors), and his brothers run a manufacturing subsidiary, Ablecom, which is based out of Taiwan.

Until 2015, key line item trends were fairly standard for a company battling it out in a relatively crowded marketplace in the face of moderately growing server demand.

While revenues (sales), costs, and expenses bumped up with a fair bit of regularity as the company made inroads into the marketplace - with Intel (ticker: INTC) initially being a prominent customer followed by Advanced Micro Devices (ticker: AMD) — the company did witness a 2020 decline in sales as the pandemic ground business to a halt.

The company, however, did have one notable feature: since 2019, growth in net income (and net income per share) had turned positive, and it was able to deliver a progressively higher net income per share despite the downturn in Fiscal Year (FY) 2020.

Note: For the company, the Fiscal Year ends on the last day of June of that calendar year.

In FY 2021, the company's imprint on the server space grew manifold with the introduction of a large family of “blade servers” built around varying requirements in cloud computing, 5G telecommunications, edge computing, and Graphical Processing Unit (GPU)-driven computing. With solutions around GPU-driven computing came an inherent edge for the “AI wave” that was then still a year or so away.

With higher capacities in processing came higher heat dissipation and inevitable acceleration in chipset damage. In FY 2023, the company debuted a series of liquid-cooled server designs that saved approximately 40% of the power required to do the same via air-cooled server designs. Both factors led to its extensive utilization in server designs built around NVIDIA (ticker: NVDA) designs.

How 2023 Led to a Year of Missed Expectations

With new edges in nascent technologies came a substantial bump in the company's net income, which bolted in earnest in 2022.

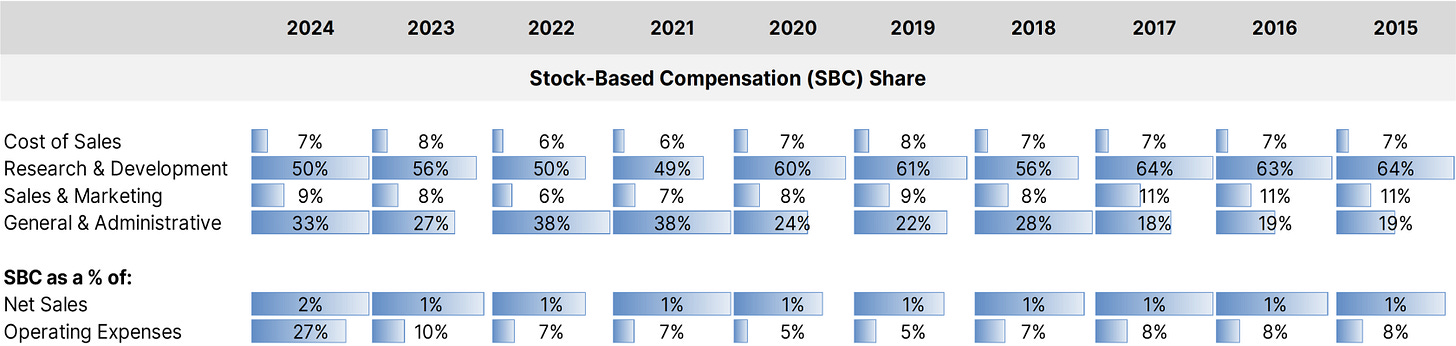

The company developed a trend of translating sales bumps into outsized net earnings while keeping operating expenses relatively low. Another trend that did kick off in FY 2023 was ballooning expenditures on stock-based compensation (SBC) for its management and workers. However, it bears noting that the share of expenses within different divisions has been relatively stable for nearly ten years now.

As a percentage of net sales and even operating expenses, the total cost of SBC had been relatively miniscule and well within a band for most of the periods examined bar one: FY 2024, i.e., the year that ended as of June 30, 2024.

In this, it could be argued that an “externality” laid a heavy hand on the company's earnings for the final quarter of its FY. It missed expectations of delivering earnings of $8.07 by delivering $6.25 (adjusted) instead despite delivering $5.31 billion in revenue versus an expectation of $5.30 billion. The externality: investor interest.

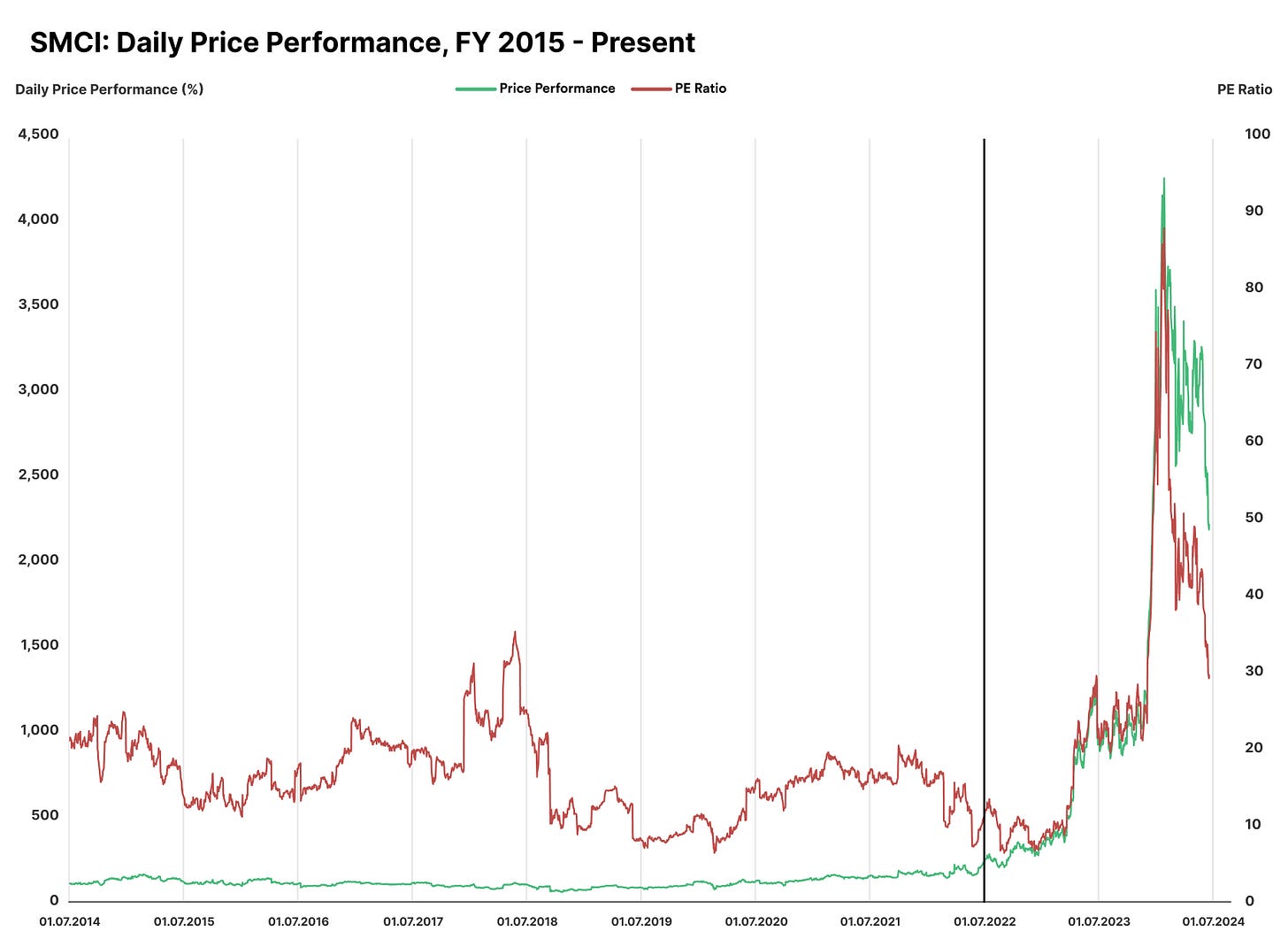

Price Performance versus Price Ratio

The comparison of the company's stock performance versus its Price to Earnings (P/E) Ratio can be divided into two “epochs” at the start of FY 2023:

Before FY 2023, while the P/E Ratio was heavily elevated at periods, it generally remained well within the semiconductor industry aggregate range of 15-25 while price performance (pegged from the start of FY 2015 onwards) maintained a fairly humdrum pace. All in all, par for the course: while server design is key for computing and the company has a history of delivering effective solutions for big-name chipmakers, the cornerstone of the semiconductor sector has always been chips.

In FY 2023, however, this changed. With Nvidia joining the ranks of its customers and its liquid-cooled solutions being deemed an effective solution, price performance (and P/E Ratio) took off all the way until the tail end of Q1 2024. Since then, trends indicate that consensus investor actions are driving the P/E Ratio toward the semiconductor aggregate range again, which has largely remained unchanged.

Across FY 2023 alone, Supermicro’s stock price rose by a massive 537%. Relative to the start of FY 2024, SMCI had surged by an additional 377% (as of March 13, 2024) before closing FY 2024 with a net FY performance of a (comparatively) paltry 229%. In this period, net sales — in comparison — had effectively doubled.

Management and workers are well within their right to receive and exercise their SBC. As they did, the net earnings magnification efficiency the company had displayed in recent times dissipated to being only an 80% increase, when a triple-digit percentage increase had been the norm in the “Age of AI Hype”.

In Conclusion

This “Age of AI Hype” has by no means ended: early trading trends in Nvidia throughout the past week indicated that an attempt at a “comeback” is being pursued, which has been a trend through all of this current week after the “Big Drop” began the week before that. Meanwhile, Supermicro continued to tread water, with early trends indicating that a further drop in price is being pursued.

What creates the “Nvdia-Supermicro” nexus is that while Nvidia's current flagship — the H100 — as well as the upcoming H200, can reportedly perform well enough in a server stack while being air-cooled, the price efficiencies for a data center increases when integrated with liquid-cooled designs. However, Nvidia CEO Jensen Huang (also from Taiwan, like Mr. and Mrs. Liang) has stated that Nvidia's next-generation DGX servers — built around next-generation Blackwell chips that purportedly consume around 1,000-1,400 watts — would necessitate liquid cooling, which will likely draw great synergies between the two companies.

However, as the article about TSMC's earnings (where the “T” stands for Taiwan) indicated, institutional investors are quite concerned that AI-driven benefits aren't nearly as transformative as to necessitate the build out of facilities being mooted by tech mega caps. They immediately depreciate in both value and performance (by wear and tear) once operational. If current data centers don't have to massively upgrade, there is no outsized incentive to rapidly switch from lower-margin air-cooled designs to higher-margin liquid-cooled designs. This spells problems for the company's forward outlook, which means the stock has significant headwinds in valuation.

On the other hand, a stock pullback would mean that SBC expenses could trend downwards in the next FY and possibly raise pass-through net income efficiency. Markets are funny sometimes when overvalued.

Notes:

The analysis of SMCI’s earnings was also published in the English language via articles on SeekingAlpha, the Tiger Brokers Community platform as well as on the Leverage Shares website.

The analysis of TSMC’s earnings was also published in the English language via articles on SeekingAlpha, the Tiger Brokers Community platform as well as on the Leverage Shares website.

Hankyung TV had also published my analysis of AMD’s Q2 earnings earlier. Click here to read. This is also available in the English language on SeekingAlpha, the Tiger Brokers Community platform as well as on the Leverage Shares website.

The “Big Dip” in early August received extensive coverage in Bloomberg, Fortune and other publications. Click here to read the full background for my commentary.

For a list of all articles ever published on Substack, click here.